Why is the shakeout effect important in the CLV model

Customer lifetime value (CLV) is often treated as a static metric.

In essence, it is shaped by how different types of customers behave – and move – over time.

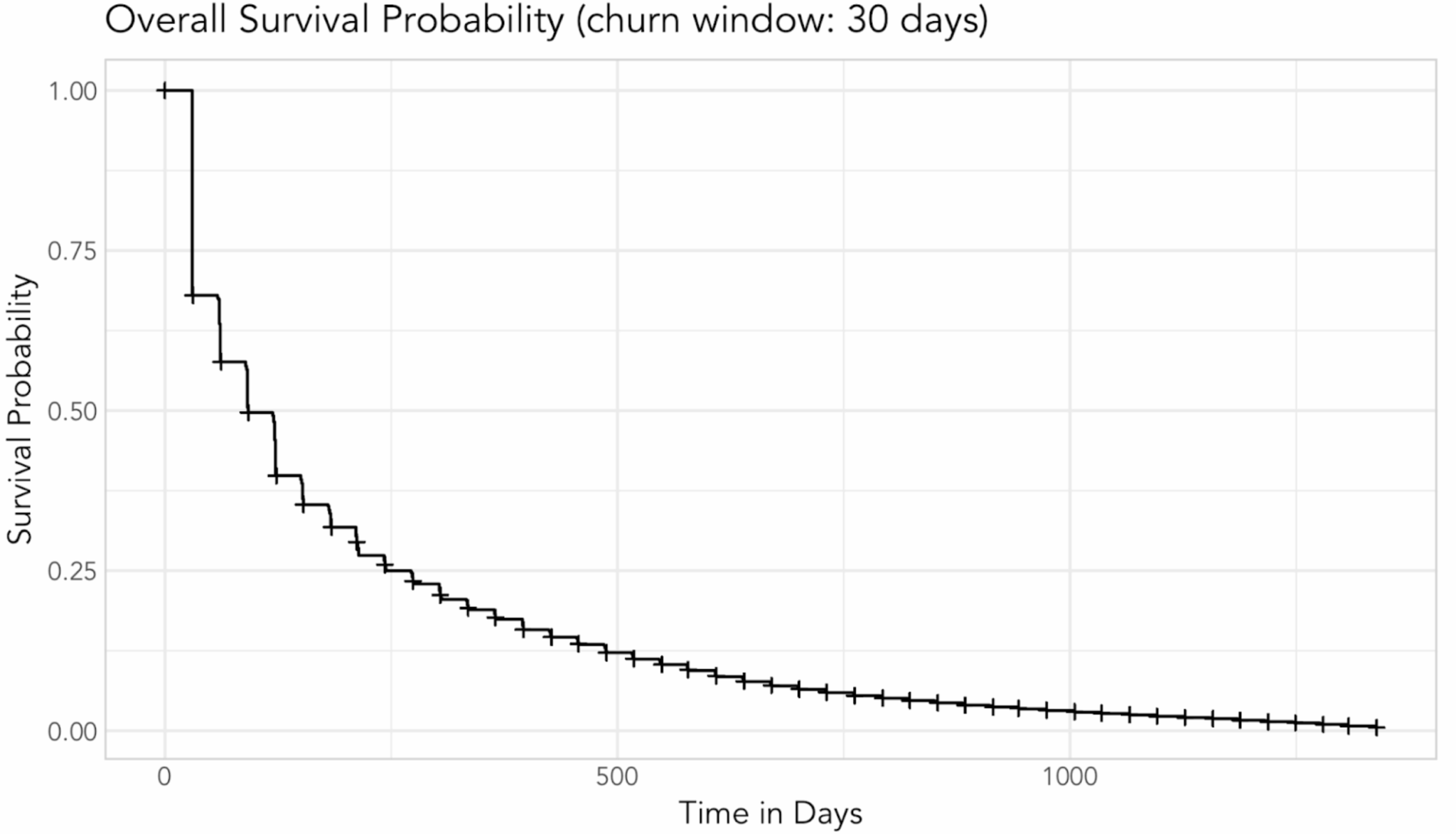

One of the most important things to understand is the “churn effect,” where early churn removes low-value customers from a group, leaving a small, stable group with high engagement and predictable purchase behavior.

This article takes a closer look at the shakeout effect in CLV analysis, why it happens, and how marketers should account for it when evaluating churn, retention, and long-term profitability.

What is the shakeout effect in the context of CLV calculations?

Consider a group of new customers.

As time goes on, all the “bad” customers fall away, leaving only the “good” ones, who have a lower propensity to drop, more engagement, better product-market fit, and predictable buying behavior.

Therefore, the overall churn propensity decreases over time. This is called the shakeout effect and is a product of heterogeneity across customers.

Over time, analysts typically use one-year windows or examine the purchase history of an entire period, but it depends.

For businesses with monthly subscriptions, the window after the first 30 days is important for analysis, as no purchases after 30 days means new customers have started.

If you look at the possibility of riding later, you will see something along those lines.

When you break down retention rates across different factors, such as UTM medium in the example below, you start to see this variation.

In this case, email as the first touch is associated with a high retention rate over time, about 27% after 500 days, while Google shows a lower retention rate, about 18% after 500 days.

Dig deeper: How to use CRM data to inform and grow your PPC campaigns

Why should the shakeout effect be important to marketers?

Not all customers are equal from a CLV perspective.

Businesses often lose money on a large percentage of newly acquired customers who churn before they register a high enough CLV to justify the acquisition costs.

Profits tend to be concentrated in a small segment of highly loyal customers.

If marketers don’t calculate churn and perform churn analysis in a timely manner, they may overestimate long-term churn, assuming early churn continues, or overestimate CLV if they ignore early losses entirely.

A solid high-level view uses the Lorenz curve and the Pareto principle, which shows that 80% of CLV comes from 20% of customers.

It is important for businesses to identify this element of loyalty, to understand what these customers’ demographics and behaviors look like, and what they particularly like about the brand and products.

There may be many customers like them out there – and the data can generate insights to help them with smarter insights and messaging.

Get the newsletter search marketers rely on.

How to spot discrepancies in your CRM

One of the easiest and most effective ways to examine your CRM data and get a sense of what is driving CLV up or down is to calculate correlation coefficient (RCC) analysis.

As a first take, we want to know if there are any features in the data that clearly show significant differences in terms of CLV.

In the example above, customers with an above-average CLV:

- Show high purchase frequency.

- Have you subscribed to the newsletter.

- You made a purchase recently.

- You are initially subscribed to at least one product.

While some of these factors aren’t practical, such as the frequency of purchases tied closely to product subscriptions, this view does a good job of suggesting what the key CLV needle connectors are.

Another easy way to get a sense of CLV across dimensions is to visualize the data distribution.

- Is it normal, skewed to the left, or skewed to the right?

- What is the average CLV by frequency?

In the example below, using a line chart, we can see that the CLV distribution is skewed to the right, with Brazil having the highest CLV, at $2,014, and India the lowest, at $820.

Which dimension you choose to analyze depends on what is available in your CRM.

At a minimum, check purchase frequency, recent availability, channel, geo, and product purchased.

For B2B specifically, I recommend using the job title, vertical, and account type, such as SMB, enterprise, and high growth.

When marketing offers multiple ways for customers to engage, I also find it helpful in adding yes-or-no dimensions to newsletter and SMS subscriptions.

More advanced statistical methods, such as collinearity analysis, stepwise regression, and random forest, help with collinearity and measure the importance of each factor in the data. I’ll save that for another topic.

Dig deeper: LTV:CAC explained: Why you shouldn’t rely on this KPI

CLV derived from the shakeout effect

In summary, experienced salespeople should:

- Account for the shakeout effect to better estimate CLV.

- Use both descriptive and predictive analytics to understand and predict what influences CLV.

- Identify and dig into their loyal segment to find similar customers in the future.

Contributing writers are invited to create content for Search Engine Land and are selected for their expertise and contribution to the search community. Our contributors work under the supervision of editorial staff and contributions are assessed for quality and relevance to our students. Search Engine Land is owned by Semrush. The contributor has not been asked to speak directly or indirectly about Semrush. The opinions they express are their own.